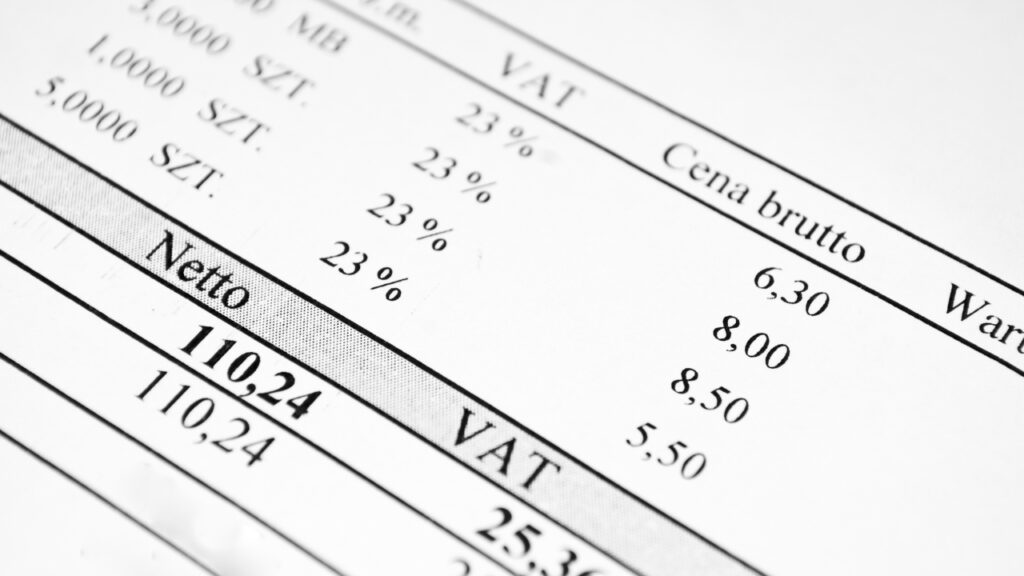

Margin VAT invoice is a special type of settlement document used in the Polish legal system, intended for entities selling second-hand goods, works of art, collector's items and antiques. This type of invoice differs from a standard VAT invoice in that VAT is charged not on the full value of the sale, but on the difference (margin) between the purchase price and the sale price of the goods. This principle is known as the margin procedure and is used to avoid double taxation of the same goods. When a margin VAT invoice is used, the seller does not separately show the amount of VAT on the invoice and this tax is not shown to the buyer. Consequently, the purchaser is not entitled to deduct the VAT included in the purchase price.